March 24, 2017

Investment to Help Disaster-affected Areas -- Initiative of Disaster Area Support Funds Initiative

Keywords: Disaster Reconstruction Money Newsletter

JFS Newsletter No.174 (February 2017)

Image by Daisuke FUJII Some Rights Reserved.

When you hear people talk about supporting areas stricken by earthquakes and other disasters, what kinds support do you think of? Visiting as a volunteer? Donating money? Buying products and vegetables produced in the affected areas? Or going on holiday there? Any of these can be a way to support disaster-affected areas.

In this issue of the JFS Newsletter, we introduce a new way to support disaster-affected areas through investment -- what are called "disaster area support funds" or "reconstruction support funds." The image many people have of investment is as a means of making money or what only the wealthy can do. How, then, do these disaster area support funds link investment with support for affected areas?

It was after the Great East Japan Earthquake on March 11, 2011 that disaster area support funds started drawing national attention. There are several types of these funds, such as one investing in local businesses in disaster-affected areas, and others investing in bonds issued by local governments in those areas, and still others that donate some of their service charges for reconstruction aid. In this issue, we would like to introduce Securite, a micro-investment platform, which offers Disaster Area Support Funds that allow you to invest small amounts of money in businesses you would like to encourage.

"Securite" Funds to support disaster-affected areas,

offered by Music Securities, Inc.

http://oen.securite.jp/ (Japanese only)

Securite Disaster Area Support Funds

Operated by Music Securities, Inc., the Securite funds to support disaster areas hit by the Great East Japan Earthquake are among those allowing investors to choose which businesses they want to encourage, and provide financial aid to local businesses in the areas by donating half of the investment and financing the other half. They have set the investment unit as small as 10,500 yen (about US$91) a share, so anyone can participate. While 500 yen (about US$4) of the price per unit is subtracted as an investment charge, 5,000 yen (about US$43 ) of the remaining 10,000 yen is donated to a local business as support and the other 5,000 yen is financed as an investment.

Securite Disaster Area Support Funds website

Fund management periods for the invested money differ by business, the longest being over 10 years. Investors may receive special gifts or dividends depending on the amount they invest. (The content of such gifts and ratio of dividends vary from business to business.) Disaster support funds, like general funds, do not guarantee the principal. In other words, investors may not always recover all of their investment. Regardless of such a risk, nearly a billion yen (about US$8.6 million) in total has been invested in them since the funds were established in April 2011, and the investors participating in the Securite funds number as high as some 30,000.

In reality, those who lost the basis of their businesses, including their shops and facilities, due to the earthquake often find it hard to rebuild their businesses relying only on ordinary means of investment however hard they strive. For this reason, the "half donation, half investment" system has great meaning.

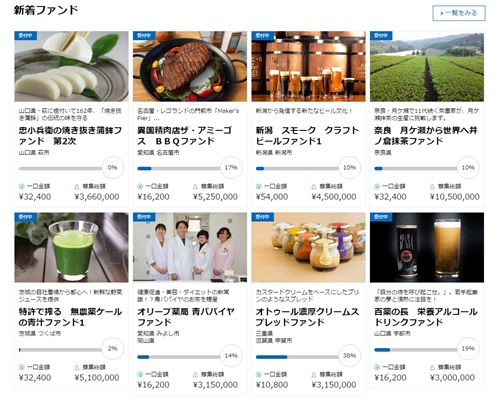

What is the actual investment process? On the Securite funds' webpage , the Disaster Area Support Funds section provides photos and introductions to many businesses in the areas affected by the Great East Japan Earthquake, such as liquor shops, fresh fish stores, seafood processors, farms and shipyards.

All of these businesses are either calling for investments or already operating on funds invested (as of February 2017, all the businesses were operating on the funds and none was calling for investments). Click on a business, and you are taken to a page where you can see its overview, its message to investors and information on special gifts and dividends to its investors. Based on this information, investors select which businesses they would like to invest in.

Supportive Framework after Investment

After the investment is made, not only do investors receive the special gifts and dividends offered, but they can also watch over the business and disaster-affected area in various ways. For example, many benefits are planned for investors in these businesses, such as opportunities to visit the businesses and the area around them through tours of facilities newly built thanks to the funds invested, or to go strawberry picking or experience rice planting.

The webpage also posts updates and information on events involving the businesses, providing reports from the disaster-affected areas. Included are reports on the current situation and issues faced by 37 businesses in the disaster-affected areas five years after the Great East Japan Earthquake. The investors can keep abreast of the situation and progress being made in the disaster-affected areas by visiting the website.

Furthermore, briefing sessions and field trips are held for the investors to hear the stories of business operators directly and visit the local area. The webpage shows reports on past sessions and trips. The Securite funds initiative gained publicity after the Great East Japan Earthquake and was covered by many media.

Currently, the Securite funds also support businesses through the Securite Kumamoto Earthquake Disaster Area Support Funds that were established after the Kumamoto Earthquake in April 2016. The first business under these funds just started accepting applications in November 2016. The investment unit is set at 10,800 yen (about US$93), and while 800 yen (about US$7) is subtracted as an investment charge, 5,000 yen (about US$43) of 10,000 yen is donated to a business as support and the rest of 5,000 yen is financed as an investment to the business just as for the Disaster Area Support Funds for the Great East Japan Earthquake.

Significance of Disaster Area Support Funds

What differences in support to disaster-affected areas are there between donations and investment to particular businesses? The major difference is the time frame. As the Disaster Area Support Funds webpage states regarding long-term involvement and follow-up until recovery, in the case of investment, the relationship between the investors and businesses continues a long time through the flow of amenities and dividends. Therefore, the investors continue to care about the businesses. This is a big difference from making a donation. Becoming an investor also creates a sense of responsibility and affects the way one watches over the situation.

Another difference is the fund system can inspire a deeper commitment from investors because of the privileges and dividends they receive, even if the original principal is not protected. Some people who feel uncomfortable about donating 50,000 yen (about US$431) may still feel able to support the fund if they can get returns such as special gifts and dividends.

A similar case was presented in the August 2016 issue of the JFS Newsletter, introducing the "Hometown Tax Program." It is quite the thing among Japanese citizens to donate money to local governments that they want to support, such as their hometowns, instead of paying taxes to the municipalities where they live. One of the reasons for this popularity is the goods these people receive in return. In the supporting funds system, special gifts and dividends can play a similar role as the return gifts from the Hometown Tax Program.

Innovative 'Hometown Tax' Donation Program Supports Municipalities

http://www.japanfs.org/en/news/archives/news_id035641.html

With its special gifts and dividends, the fund may provide those who have had no mind to donate so far with opportunities to support disaster-affected areas. Moreover, it can also familiarize the idea of contributing to society through investment with those who have had no interest in investing so far or who think of investment as just a money-making scheme. Since the fund has an easy-to-understand framework for supporting specific businesses, it may have great potential to help people understand the social significance of investment.

Regarding that significance, there is a movement growing worldwide now that enables people to change the world by paying attention to where their investment money goes. A typical example is "divestment": people start withdrawing their investments from stocks and mutual funds of businesses with ethical issues. In Europe and the United States, divestment from fossil fuel industries is spreading among universities and businesses.

In addition, sustainable investment, called ESG investment (ESG stands for environment, society and governance), focusing not just on economic performance but also on the environment and society, has a global market exceeding 10 trillion dollars. Although in Japan such movements as divestment and ESG investment are gaining attention little by little, they have not gained popularity among the public.

Substantial Change toward Expansion: The Sustainable Investment Market in Japan

http://www.japanfs.org/en/news/archives/news_id035682.html

We will keep an eye on the initiative to assist disaster-affected areas through Disaster Area Support Funds, of course, but also watch for the possibility that the idea of investing to contribute to society will catch on with the public.

Written by Naoko Niitsu

Related

"JFS Newsletter"

- 'Good Companies in Japan' (Article No.4): 'Eightfold Satisfaction' Management for Everyone's Happiness

- "Nai-Mono-Wa-Nai": Ama Town's Concept of Sufficiency and Message to the World

- 'Yumekaze' Wind Turbine Project Connects Metro Consumers and Regional Producers: Seikatsu Club Consumers' Co-operative

- Shaping Japan's Energy toward 2050 Participating in the Round Table for Studying Energy Situations

- 'Good Companies in Japan' (Article No.3): Seeking Ways to Develop Societal Contribution along with Core Businesses